Company: Judo Bank

Year: 2022 - 2024

Role: Experience Design Lead

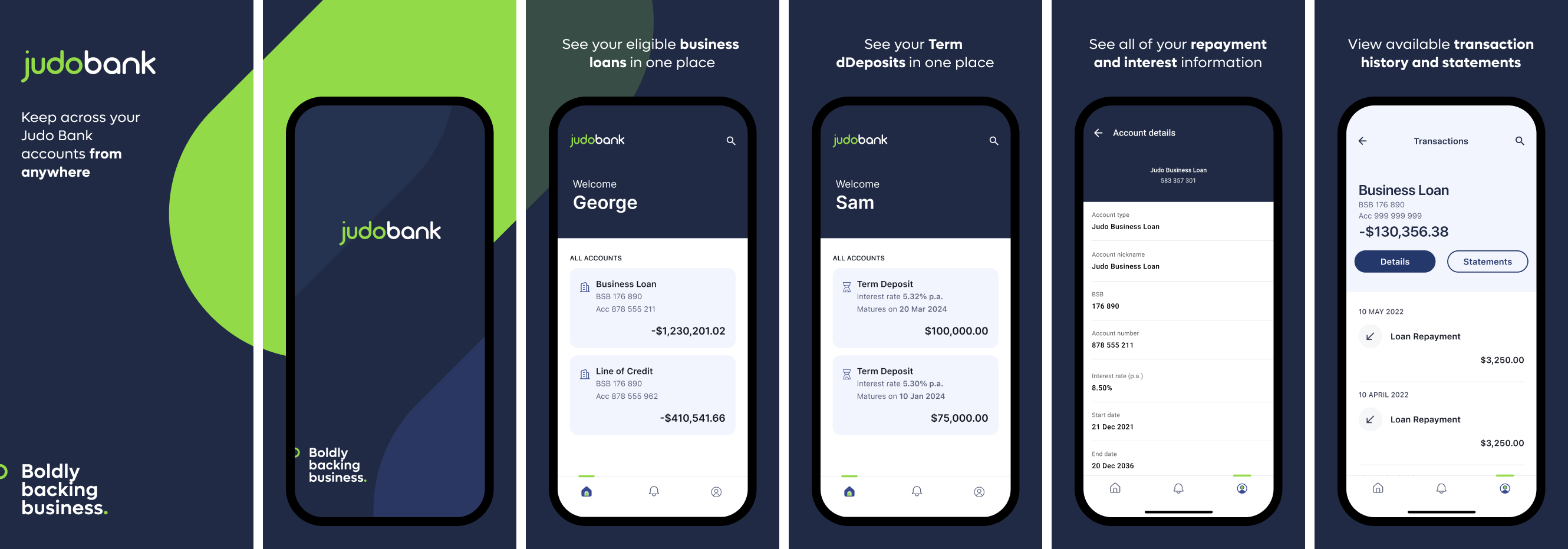

Launching Digital Banking for Australia's newest bank that specialises in small to medium (SME) business lending.

A bank that had grown off the back of high-touch face-to-face business relationship banking needed to round out the offering with a complementary digital experience.

Judo Bank has two key customer segments: SME Business Lending and Term Deposits.

As Lead Product Designer, I worked with a Senior Product Designer, a Product Owner, and a team of engineers to launch a Digital Banking offering within a year.

The role spanned the full Product Design skill set—from Discovery to Delivery.

Key activities:

Judo customers were eager for a digital experience to complement relationship banking. Speed to market was key. Product design was a new function, and we had to introduce it on one of the bank’s largest initiatives.

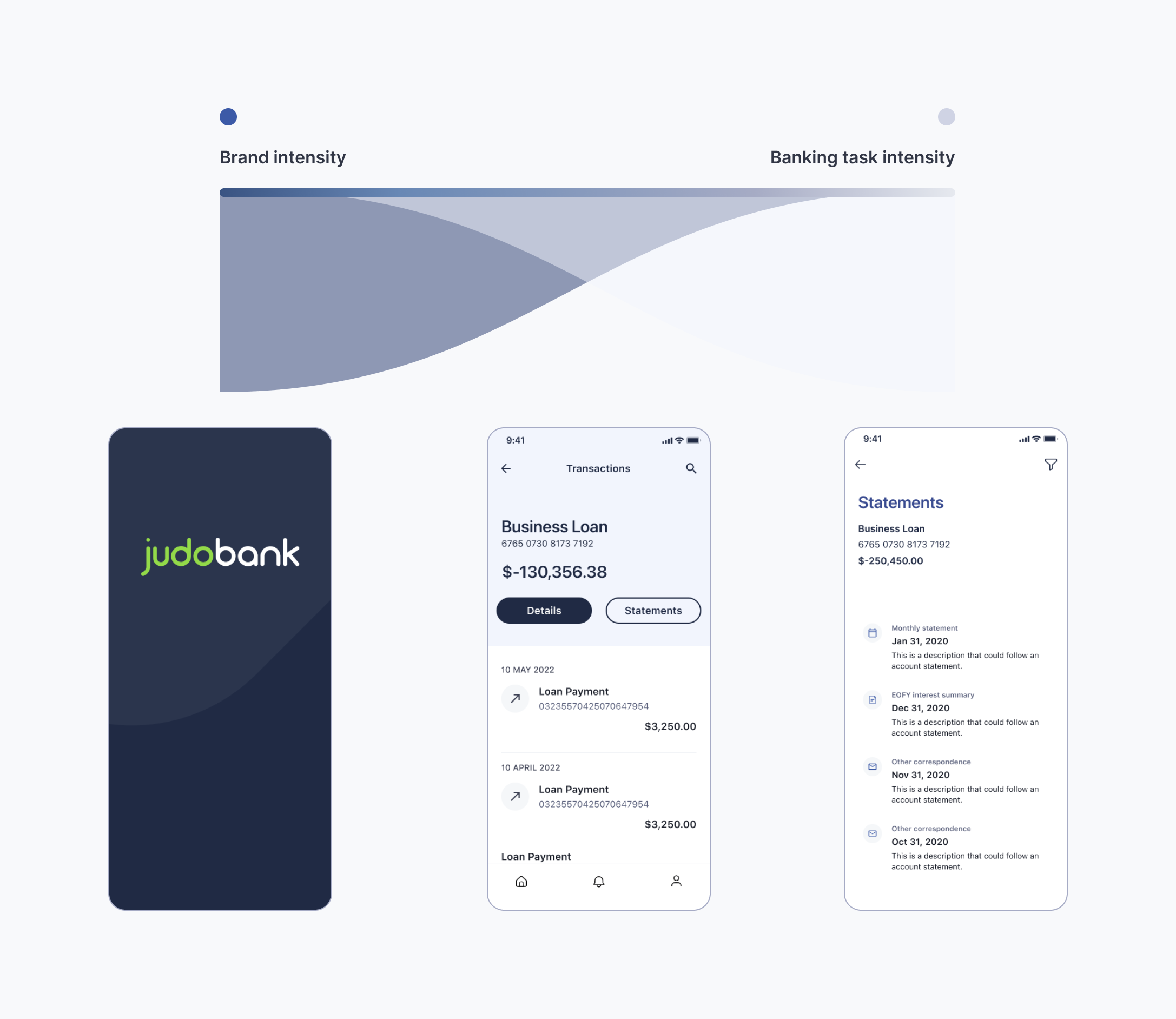

We partnered with Backbase—a white-label global banking platform—and tailored their out-of-the-box experience to meet our customers' needs.

Launch a Digital Banking Platform from scratch, within 12 months.

out of the boxexperience with customers

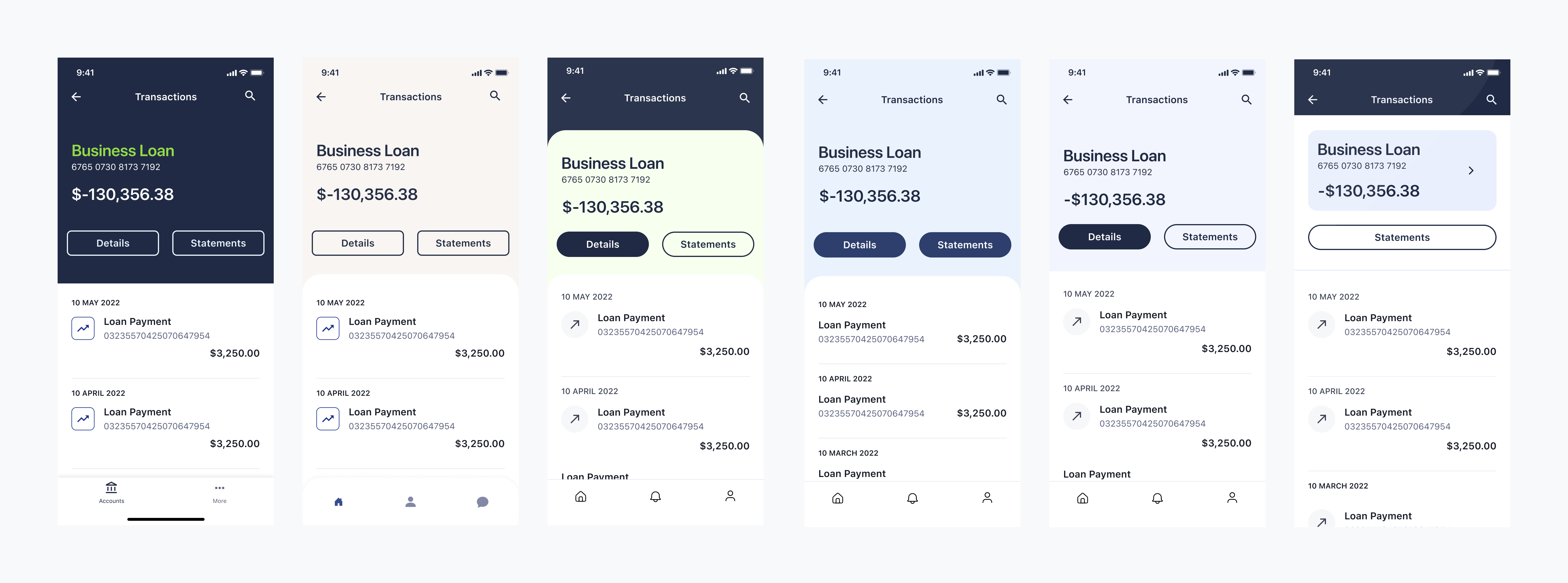

I collaborated with the Director of Design—each of us explored independently, then merged ideas.

The challenge was to make the existing brand work within a constrained UI environment.

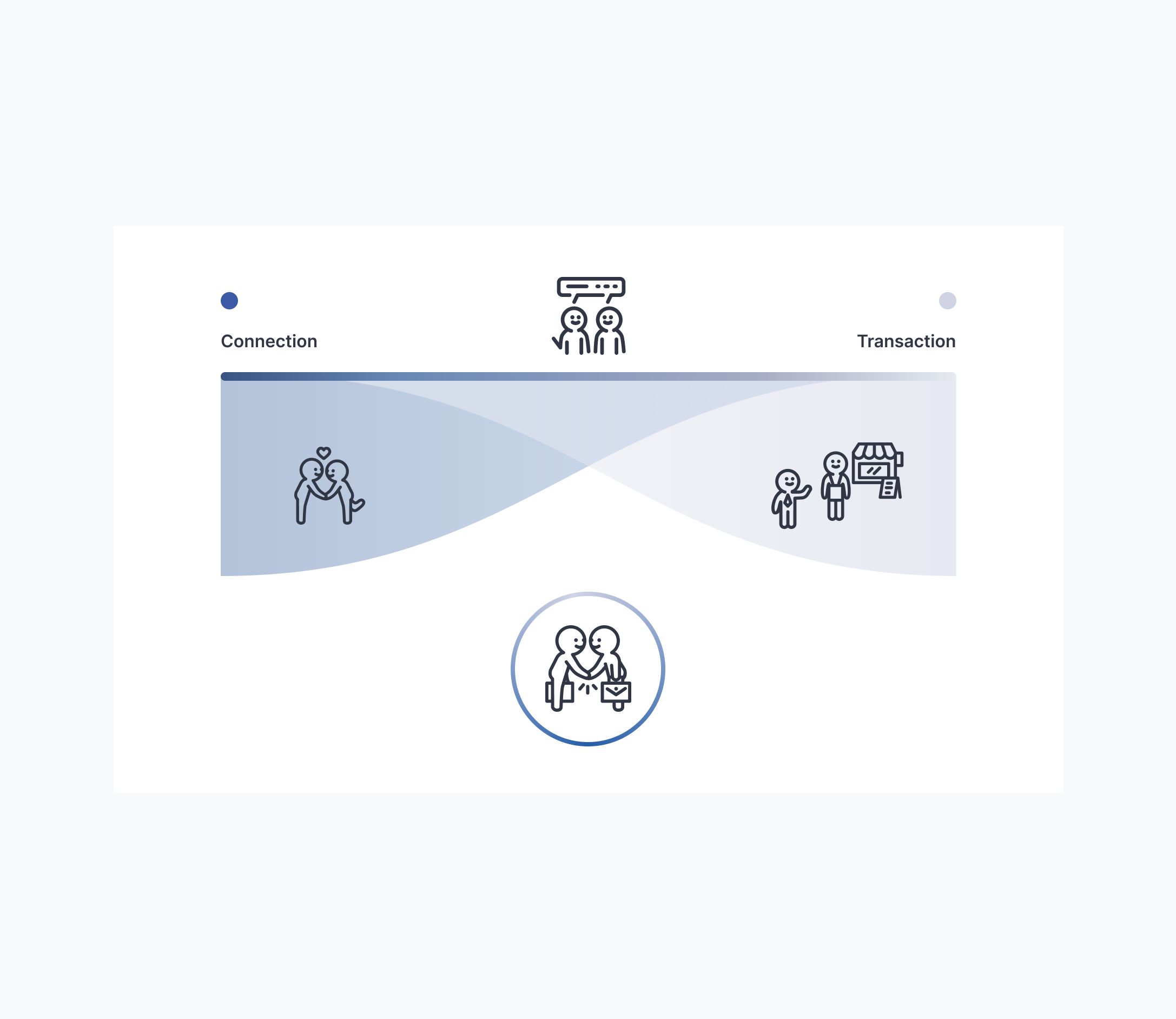

Conceptually reflecting Judo Bank's approach to customers.

The experience simplifies as functionality increases.

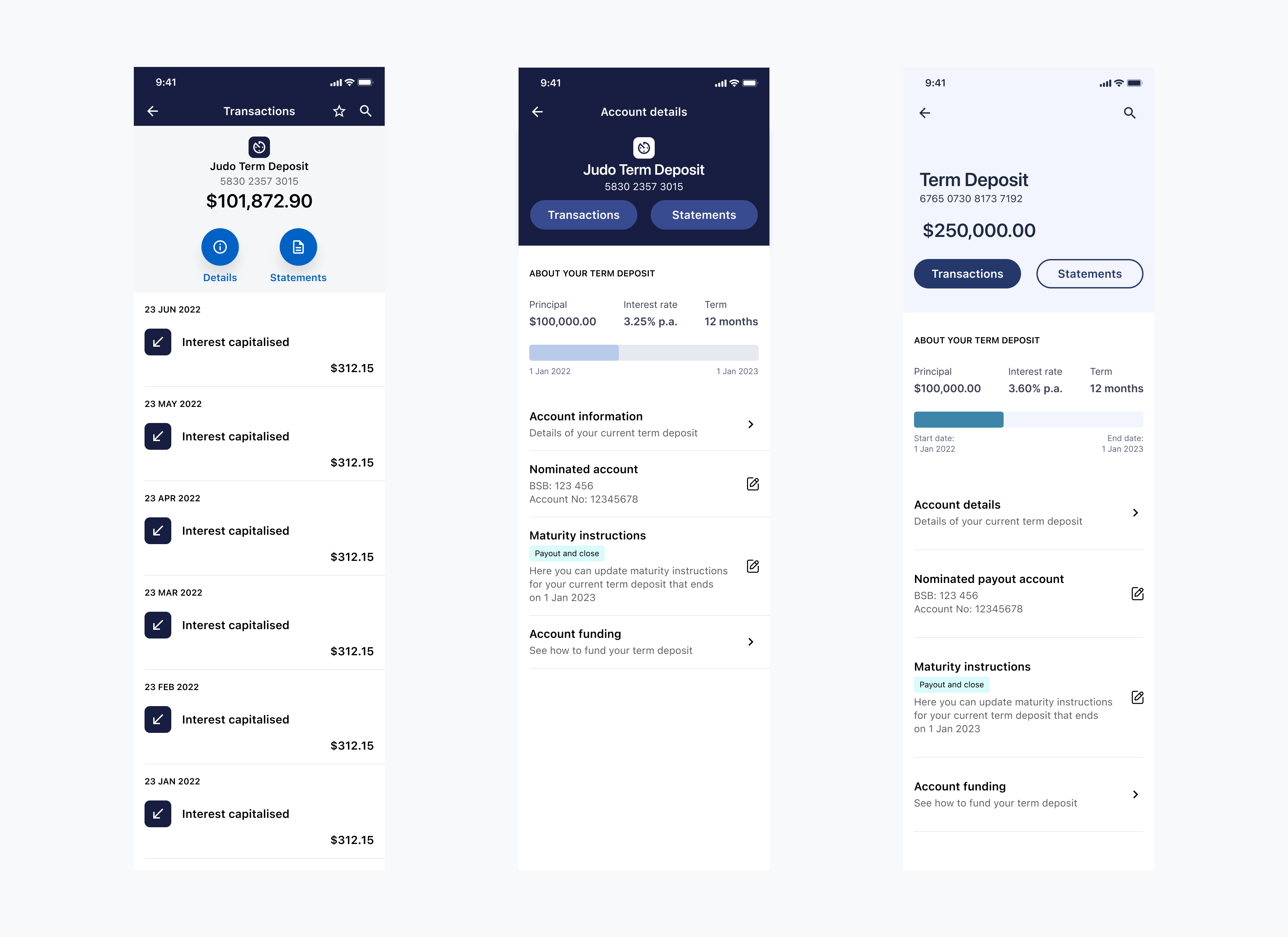

The key screens of the customer experience.

We kicked off customer interviews to understand behaviours and needs. There was internal debate about prioritising app over web—but interviews showed both were necessary.

Quick check-into monitor loan balances and payments casually.

By talking to customers, we learned that device compatibility is important. We made sure to prioritise it in our delivery plan.

Using a test-and-learn approach, we validated:

Backbase covered ~80% of needs. Our research helped close the remaining 20% with meaningful, delight-driven improvements.

Unlike transaction-focused users, they want to see interest rates, terms, and maturity instructions front and centre.

Rapid prototyping and testing helped us quickly understand Term Deposit customer needs.

Design helped communicate staged releases of the platform clearly. We tested messaging with customers to ensure clarity and engagement.

Go-to-market assets.

Customer engagement materials.

Launching a digital banking solution from scratch is a big task. My approach was to always ask:

What data and insights do we have—or need—to make this decision?

This helped the team stay aligned and adaptive throughout.